Trust Foundations in Management: Producing a Solid Bedrock for Business Success

Wiki Article

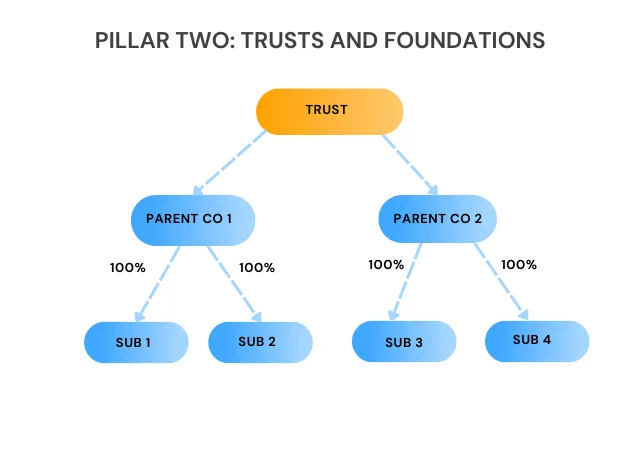

Building a Strong Trust Fund Structure: Our Offshore Trust Services

Advantages of Offshore Depend On Solutions

One of the crucial advantages of offshore trust fund solutions is possession defense. By placing your possessions in an overseas trust, you can guard them from lawful conflicts or prospective financial institutions. Unlike residential trust funds, offshore counts on offer a higher level of discretion as they are not subject to public disclosure demands.Exactly How Offshore Counts On Protect Your Properties

One means offshore counts on protect your possessions is through the principle of legal separation. When you transfer your properties to an offshore trust, they are no much longer considered your individual property.

Another way offshore counts on secure your possessions is via using privacy. Offshore jurisdictions often have rigorous personal privacy regulations that secure the identity of the trust's recipients and their possessions. This confidentiality can make it testing for 3rd events to recognize and find your possessions, offering an added layer of defense.

In addition, overseas depends on supply the advantage of property diversification. By holding your assets in different territories, you can spread your risk and reduce the impact of any potential financial or political instability in your house nation. This diversification can help make sure the lasting preservation of your wealth.

Trick Considerations for Picking an Offshore Trust Fund Provider

To ensure the security and effectiveness of your offshore depend on, it is vital to meticulously consider essential elements when selecting a trust fund carrier. You ought to focus on the carrier's credibility and experience. Try to find a carrier with a tested record in protecting and handling overseas counts on customer properties. A reliable carrier will certainly have a solid understanding of international trust fund laws and guidelines, making sure that your trust fund is well-protected and legitimately certified.An additional vital factor to consider is the territory in which the trust supplier operates. Various territories provide differing degrees of personal privacy, asset protection, and tax obligation advantages. You must pick a jurisdiction that lines up with your certain requirements and goals. Additionally, it is essential to evaluate the company's interaction and customer support capacities. You want a trust provider that is responsive, clear, and able to give regular updates on the status of your count on.

Steps to Establish Up an Offshore Depend On

To successfully establish an overseas trust fund, you will need to follow a collection of actions that make sure conformity with global laws and secure the integrity of your properties. The initial step is to pick a jurisdiction for your offshore count on. Various territories offer varying degrees of privacy, tax advantages, and property security, so it is essential to research study and select the one that lines up with your goals. As soon as you have actually picked a jurisdiction, the next step is to involve the solutions of a reputable offshore trust fund supplier. They will lead you with the process and help you browse the complicated lawful requirements. The 3rd action is to prepare the trust fund action, which describes the terms of the count on. This file should plainly define the possessions, recipients, and trustees involved. After the trust action is wrapped up, you will certainly require to Discover More fund the depend on by moving the properties right into it. This step needs mindful consideration and intending to ensure that the possessions are appropriately secured. It is crucial to frequently examine and upgrade your offshore trust fund to guarantee it proceeds to satisfy your needs and complies with any type of adjustments in regulations. By complying with these steps, you can develop a strong offshore trust fund that provides protection and assurance.Preserving and Upgrading Your Offshore Trust Fund

Regularly reviewing and upgrading your overseas trust fund is important to ensure it continues to fulfill your demands and follow any adjustments in regulations. As your circumstances transform, it's essential to assess whether your depend on framework still aligns with your objectives. By frequently evaluating your overseas trust fund, you can identify any type of needed modifications and take proactive actions to enhance its efficiency.Upgrading your offshore depend on allows you to adapt to changes in tax obligation regulations, policies, and financial scenarios. By remaining notified concerning any alterations in the legal landscape, you can make sure that your depend on continues to be compliant with current policies. This proactive technique assists you prevent any type of prospective penalties or lawful concerns that may occur from non-compliance.

In enhancement to regulative changes, upgrading your overseas trust fund enables you to deal with any modifications in your monetary or personal circumstance (trust foundations). Life occasions such as marital relationship, birth, fatality, or divorce might call for alterations to your depend on arrangements. By frequently examining and upgrading your trust fund, you can make sure that it mirrors your current desires and conditions

To keep the stability of your overseas trust, it's vital to work very closely with trusted consultants that concentrate on overseas trust fund solutions. These specialists can help you browse the intricacies of count on management and provide guidance on needed updates and conformity demands. By focusing on regular evaluations and updates, you can ensure that your overseas trust fund proceeds to function as a strong structure for your economic objectives and goals.

Conclusion

Finally, overseas depend on solutions give countless advantages such as asset defense and tax obligation advantages. By picking important link a reliable overseas trust company, you can develop a solid foundation of trust and safeguard your possessions. Setting up an overseas trust involves a few vital actions, yet when developed, it is essential to consistently maintain and upgrade it to ensure continued performance. With the best method, overseas trusts can offer a trusted and safe and secure way to protect and handle your assets.Unlike domestic trusts, offshore trust funds give a greater level of discretion as they are not subject to public disclosure needs.To make certain the protection and efficiency of your overseas count on, it is vital to very carefully consider vital variables when selecting a trust fund service provider. After the trust fund deed is wrapped up, you will require to fund the trust fund by moving the properties right into it.To preserve the honesty of your offshore trust, it's important to work carefully with relied on web link experts who specialize in overseas count on services. By choosing a dependable offshore trust fund provider, you can develop a strong structure of trust and safeguard your assets.

Report this wiki page